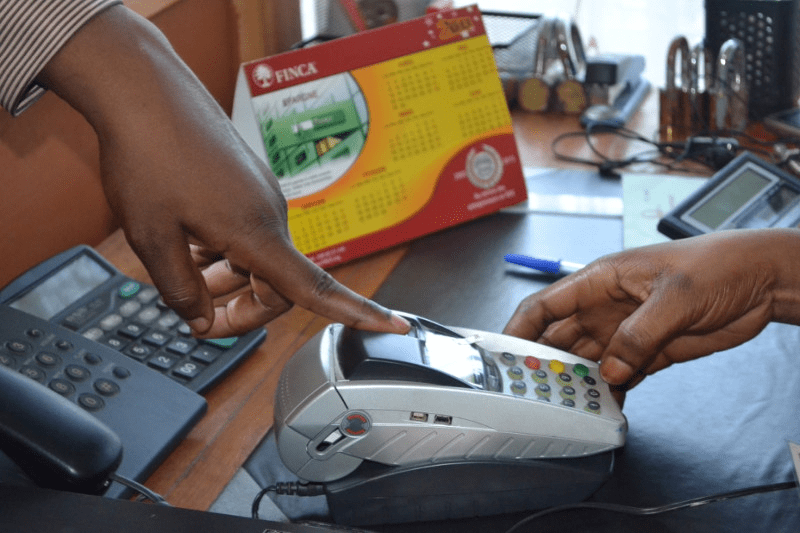

New FIF White Paper looks at successful efforts by FINCA DRC to create new products and delivery channels that emphasize outreach and efficiency. FINCA DRC is building even closer relationships with clients while increasingly utilizing digital channels.

Andrée Simon: Psychometric Credit Scoring Helps Reach Unbanked

Fintech and digital financial services have made banking possible for more people around the world. But while bank accounts and digital payments are more available, for many entrepreneurs in low-income countries, getting a loan is more difficult. Psychometric credit scoring can help.

Caren Robb on Fintech and Financial Inclusion for Women

Despite increased financial access overall, the gender gap hasn’t changed much since 2014. And while fintech has potential to empower women, fintech and financial inclusion for women don’t necessarily go hand-in-hand. In a recent op-ed, Caren Robb discusses ways that financial institutions can promote gender-equitable financial inclusion and close the gender gap.

FINCA Azerbaijan to Meet Need for Financial Inclusion With Transformed Business Model

An external financial crisis required FINCA Azerbaijan to transform its business model. Now a scaled-down, more efficient operation, it will expand financial inclusion through a combination of branches and digital banking channels.

FINCA Impact Finance Announces Caren Robb as Global Chief Operating Officer

Caren Robb will be responsible for overseeing the financial performance of FIF’s network of 20 community-based banks and microfinance institutions and the integration of digital technologies into its banking practices.

FINCA Impact Finance subsidiary in Armenia issues $2.8 million bond offering

The USD 2.8 million bond issuance will support on-lending to small businesses. It is the third successful bond issuance by FINCA Armenia since 2017.

FINCA Impact Finance Partners with Comic Relief and Jersey Overseas Aid to Transform Agent Network in Zambia

GBP 800,000 in funding will support upgrading FINCA Zambia’s agent banking network, reaching underserved population segments through financial technology innovation. The project will expand the agent network while evolving its business model to better meet the needs of customers.

FINCA Impact Finance, MEF and BlueOrchard Announce USD 20 Million Loan Facility

FINCA Impact Finance has entered into a USD 20 million loan facility with the BlueOrchard Microfinance Fund (BOMF) and Microfinance Enhancement Facility S.A., SICAV-SIF (MEF). The facility will help FIF better manage liquidity throughout its global network of 20 microfinance banks and institutions.

FINCA Impact Finance’s “Rebuilding Kosovo” Video Wins Silver Telly Award

FINCA Impact Finance opened its doors in Kosovo in 2000 to advance the mission of expanding financial inclusion to help individuals, families and communities recover from the war. This year FINCA Impact Finance won the Silver Telly Award for Rebuilding Kosovo: One Loan at a Time, a video highlighting the role of financial inclusion in the country’s recovery.

FINCA Impact Finance and KfW Announce USD 8.5 Million Subordinated Loan Facility for Democratic Republic of Congo

FINCA DRC announced a USD 8.5 million long-term subordinated loan facility with KfW, the German state-owned development bank. The facility will enable FINCA to advance its digital transformation and broaden its offering of innovative financial products and services.

Business Loans for Women Headline Gender-Sensitive Finance Strategy

FINCA provides business loans for women entrepreneurs along with other gender-sensitive finance services to help close the gender gap in financial access. In 2018, the company opened a women-only bank branch in Afghanistan and launched a new loan for women entrepreneurs in Kosovo.