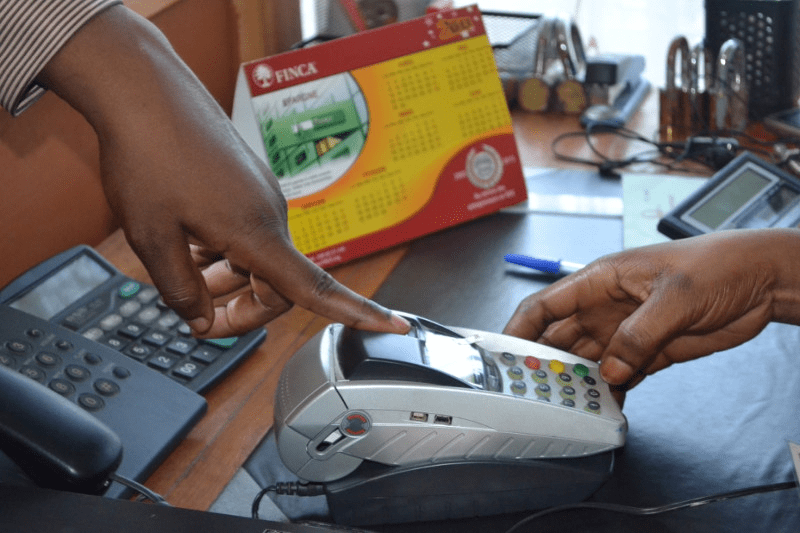

GBP 800,000 in funding will support upgrading FINCA Zambia’s agent banking network, reaching underserved population segments through financial technology innovation. The project will expand the agent network while evolving its business model to better meet the needs of customers.

FINCA Impact Finance Partners with Finastra to Meet IFRS9 Regulatory Standards

Fusion Risk will help FINCA Impact Finance ensure regulatory compliance and data management as it continues to implement digital innovations to improve efficiency and better serve its customers.

FINCA Uganda Partners with SafeBoda to Provide Mobile Fintech Product

FINCA Uganda establishes a new fintech innovation partnership with SafeBoda to expand financial inclusion in Uganda. Motorcycle taxi riders will be offered access to mobile savings and credit products.

FINCA Impact Finance and KfW Announce USD 8.5 Million Subordinated Loan Facility for Democratic Republic of Congo

FINCA DRC announced a USD 8.5 million long-term subordinated loan facility with KfW, the German state-owned development bank. The facility will enable FINCA to advance its digital transformation and broaden its offering of innovative financial products and services.

FINCA Helps Launch Global Guidelines for Responsible Digital Finance

Improved risk management is necessary to achieve responsible financial inclusion. That’s why FINCA Impact Finance joined an alliance of over 50 fintech investors and digital finance innovators in launching the Guidelines for Investing in Responsible Digital Financial Services.

FINCA Provided Responsible Finance to 27% More People in 2017

2017 was a turnaround year for FINCA Impact Finance. The company returned to profitability while launching new initiatives in client protection, Fintech, mobile banking and data analytics, among others.

For Responsible Financial Inclusion, We Need to Encourage Saving

When used intentionally, Fintech innovation can help encourage saving. In Tanzania, FINCA launched HaloYako, a mobile banking product that allows clients to open a savings account in minutes–and manage their savings entirely virtually.

Fintech Innovation Helping Expand Financial Inclusion in Pakistan

FINCA Impact Finance is using Fintech innovation to expand financial inclusion in Pakistan, a country where only 21% of adults have a formal bank account. In 2017, FINCA Pakistan launched SimSim, a free mobile e-wallet that already has more than 170,000 users.

How FINCA is Leveraging Fintech Innovation for Financial Inclusion

FINCA Impact Finance is using Fintech innovation to break down barriers to financial inclusion—at the same time, it’s ensuring those technologies deliver impactful and responsible financial services to empower entrepreneurs and communities across the globe.

FIF Subsidiary in Pakistan Partners with Karandaaz on Digital Financial Services

FINCA Microfinance Bank Limited announced a strategic partnership with Karandaaz Pakistan to expand responsible finance by enhancing delivery of digital financial services. The partnership will target women entrepreneurs engaged in micro and small-business activities.

#IWD2018: Women Leaders in Finance Talk Fintech, Financial Inclusion

Fintech innovation can help close the gender gap—but intentional, targeted action is necessary to ensure new technologies are used in the right ways—and for the right reasons.