How Education Accelerates the Impact of Financial Inclusion

by Zar Wardak, Vice President of Business and Customer Strategy, FINCA Impact Finance

Education is a proven and powerful driver of upward social mobility. FINCA invests in financial education that empowers our customers to use their funds wisely, and supports our customers in providing an education for their own children.

Learning and capacity building for our customers is key to meeting FINCA’s mission of ending poverty where we work. Education in all its forms is part of a holistic approach to providing opportunity to our customers so they can make informed choices that help them realize their potential.

Making Education Affordable

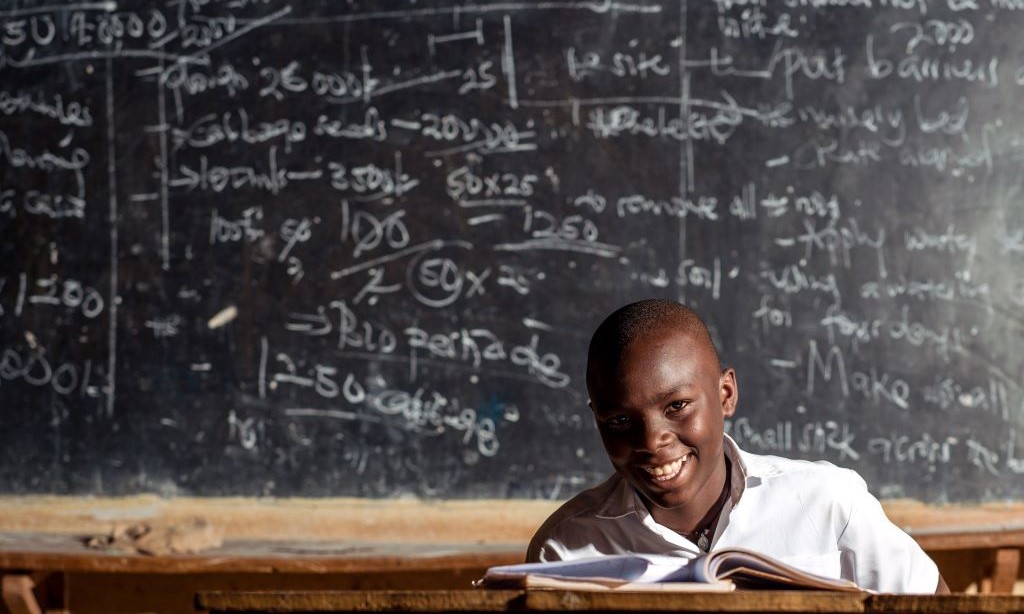

According to a United Nations study, 420 million people could be lifted out of poverty if they completed secondary schooling. So why are so many millions of young people still out of school? Cost is the underlying obstacle.

Some families require their children to work to make ends meet, which keeps those children out of school. Those who can manage without their children’s income often cannot afford tuition, uniforms, and books.

FINCA’s customers tell us that keeping their children in school is a top priority, and that they need support to make that happen. Loans and savings accounts can help, but few financial institutions accept low-income clients, and those that do often do not fully listen and respond to their customers’ specific needs. FINCA is changing that.

Supporting Entrepreneurs

Justine is a single mother of four in Uganda and the owner of a hair salon. She lost both parents at a young age, and without their support, she was unable to get an education. Her dream is to do better for her four children, but says it was hard to find the money at the right time to pay tuition.

Opening a savings account with FINCA has helped. Prior to FINCA, Justine was saving with another bank. She left it because she said the bank made her feel “small and unimportant,” the financial offerings were expensive and inaccessible, and she lacked access to support from bank employees.

Justine saves about $1.40 USD per day with FINCA. When she wasn’t able to hit her original goals, she was ready to give up. Justine credits her FINCA finance coach, FINCA financial workshops, and visits from FINCA staff with helping her to stay motivated.

Investing in Community Schools

Access to quality education can also be a concern for low-income families. FINCA loans help clients build or expand schools in their communities. Some FINCA subsidiaries offer loans tailored specifically for this purpose.

Furaha took out a FINCA Tanzania loan in 2010 to open a private kindergarten in their village. In 2017, it became apparent that the community needed a primary school, as well. Traditional commercial banks refused Furaha’s loan requests, but FINCA came through with a loan of $8,100 USD, which allowed Furaha and her husband to build five new classrooms and dig a water well for the students. By early 2020, 300 students were attending the primary school.

When the pandemic struck, Furaha had to temporarily close the school. And with no tuition income coming in, she could no longer afford her loan payments. FINCA restructured her loan, offering a four-month grace period until schools re-opened.

FINCA’s flexible collateral requirements and repayment plans make loans more accessible to low-income individuals who, under more traditional loan constraints, would not be able to afford them. And a commitment to personal customer service helps customers build resilience when unexpected shocks threaten their plans.

Advancing Financial Literacy

FINCA offers free, reliable financial education and coaching that helps families budget for school expenses and weather unexpected economic shocks. Many FINCA country operations also offer in-school programs, internships, and other opportunities that equip young people with the financial skills they need to thrive as adults.

Embracing a Broader Approach to Ending Poverty

In addition to offering financial solutions to individual families and schools, FINCA partners with organizations committed to providing resources and eliminating barriers that keep children from learning.

Students in sub-Saharan Africa have access to quality learning tools through a FINCA Ventures investment in Eneza Education, which makes low-cost supplemental educational material available to students via mobile phone. Users score 22% higher on national exams than their peers. Because they can continue to use Eneza’s Shupavu product during crises like the COVID-19 pandemic, Shupavu users are more resilient to economic, political, or health shocks that could otherwise derail their learning.

A recent $500,000 USD grant from the Conrad N. Hilton Foundation will support FINCA’s work to provide refugees and host communities in Uganda with access to affordable, sustainable, quality early childhood education. FINCA Ventures’ investment in Rising Academies will promote quality K-9 education by providing an affordable all-in-one digital school improvement solution to education providers in Sierra Leone, Ghana, Liberia, Uganda, and Rwanda.

We will continue to connect with our customers as we explore new partnerships and test fresh solutions designed to keep children in school. Based on current trends, 17 million children worldwide will never set foot in a classroom. Our goal is to disrupt that trend through continued innovation that meets customers’ needs, expands access to education and helps end poverty.